A Co-Authored piece by Christos Richards, David Schumer, Luis DeAnda, Antonia Halliday, James Flashman-Fox, Severine Balick, Victoria Lakers, James Brocket, & Tom Barnes

Should the CEO also serve as Chair of the Board?

While there’s no one-size-fits-all answer, governance best practices increasingly recommend separating the roles of CEO from the Chair of the Board, especially in times of leadership transition or strategic inflection.

At Calibre One, across all Practices, we have explored the evolution of this trend, what the most recent 2024–2025 data show, and why more companies may benefit from evaluating their board leadership structure not as a rigid rule, but as a reflection of governance maturity.

Note: Insights on the evolving role of independent chairs have been shaped in part by prior industry research conducted by leading governance advisory firms, together with these author’s 25+ years of experience in building boards of directors.

Rethinking Board Leadership: Why Separating the CEO and Board Chair Roles Merits Consideration

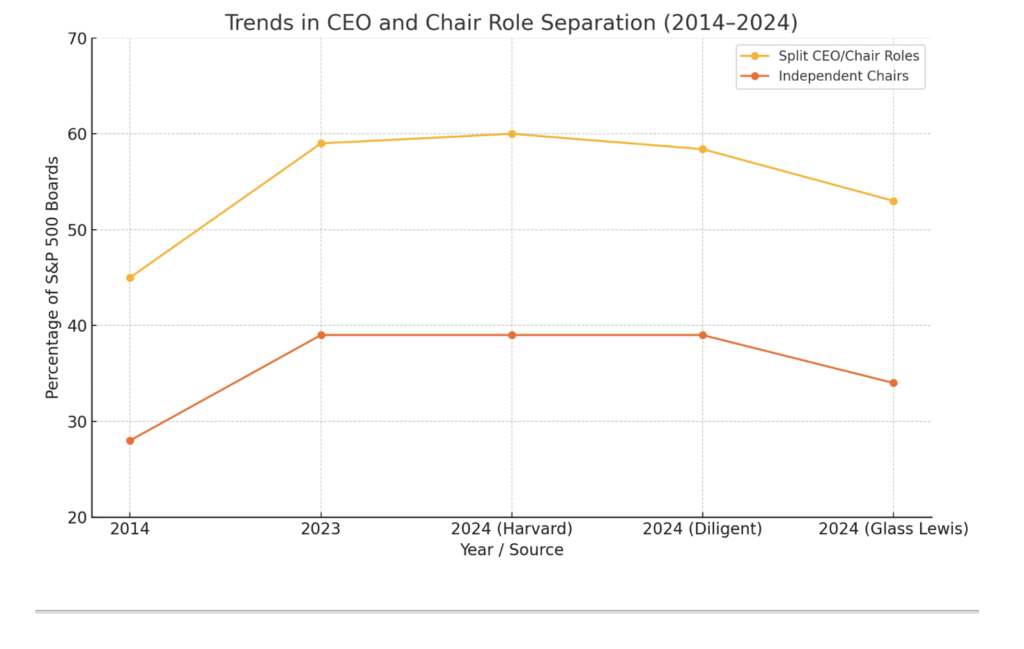

Over the past decade, boardroom governance has gradually evolved. Historically, it was common for public company CEOs to also serve as chair of the board. Today, governance experts, proxy advisors, and investors are increasingly encouraging companies to consider separating these roles. While one global search firm 2023 report shared that that nearly 60% of S&P 500 companies had already done so, updated figures from 2024 indicate a plateau, with estimates ranging from 53% to 60%, depending on the source.

As we continue to consider best-practices in corporate governance, we offer these perspectives on why the trend toward role separation is worth thoughtful evaluation, the implications for boards, and the direction industry is taking.

The Rise of Role Separation

In 2014, only 45% of S&P 500 companies had split the CEO and chair roles. By 2023, that number had grown to 59%, and data from Harvard and Diligent in 2024 suggest it is holding steady around 58.4% to 60%. Glass Lewis, a leading proxy advisory firm, estimates the figure at 53%.

Among those companies that have separated the roles, the degree of independence varies. In 2023, approximately 66% of separated chairs qualified as independent under NYSE or Nasdaq rules, equating to about 39% of all S&P 500 boards. Glass Lewis reported in 2024 that only 34% of companies had fully independent board chairs.

This highlights an important nuance: structural separation does not always equate to full governance independence. Boards may wish to assess whether their leadership structures deliver the intended checks and balances.

Why Consider Separation?

The case for separating the CEO and chair roles centers on accountability and oversight. When one executive holds both titles, it can lead to ambiguity in oversight responsibilities.

By contrast, separating the roles introduces a clearer distinction:

- The CEO leads day-to-day operations and executes strategy.

- The independent chair focuses on facilitating effective board governance, setting agendas, and supporting oversight.

Independent chairs often serve as a sounding board for the CEO, facilitate executive sessions, and represent the board in shareholder engagements. While not a one-size-fits-all solution, many believe that separation strengthens governance.

Data and Shareholder Perspectives

In early 2024, 37 shareholder proposals advocating for role separation were introduced, garnering an average of 32% support. In some sectors, such as financial services, support exceeded 60%.

Proxy advisors have increasingly called for independent board leadership. Glass Lewis and Institutional Shareholder Services (ISS) have made recommendations aligned with this view. While the 2024 ISS-backed proposal at Goldman Sachs did not pass, it reflects rising scrutiny of combined leadership structures.

Case Example: Celanese Corporation

Celanese Corporation provides one recent example of thoughtful leadership transition. In December 2024, the company announced that effective January 1, 2025, Scott Richardson would assume the CEO role, and Edward Galante, a long-tenured independent director, would become non-executive chair.

This governance evolution was positively received and illustrates a considered approach to separating roles, aligned with succession planning and oversight principles.

The Role of the Independent Chair

The role of an independent chair goes well beyond chairing meetings. According to interviews conducted by a leading advisory firm, independent board chairs often:

- Lead governance: Collaborate on agendas, conduct evaluations, and interface with committees.

- Manage meetings: Ensure effective board and executive session dynamics.

- Mentor executives: Offer confidential guidance to the CEO.

- Engage with shareholders: Represent governance perspectives externally.

- Guide succession: Participate in director onboarding and planning.

Soft skills such as emotional intelligence, communication, and the ability to foster collaboration are viewed as essential.

A Matter of Fit and Timing

Optimal board leadership structure will vary by company, industry, and phase of growth. Some boards will find that combining the roles makes sense and works well under specific conditions, while others may benefit from evaluating whether an independent chair could contribute to enhancing effectiveness.

It is not about prescribing a rigid model. Instead, it is about encouraging regular reflection:

- Does your leadership structure serve the company today?

- Will it serve you tomorrow amid evolving complexity?

- What are the company’s objectives, deliverables and aspirations over the next three to five years?

Recommendations for Consideration

As companies evolve, so too should governance practices. Boards should consistently be considering growth, evolution, and rebalancing composition to meet near- and long term deliverables/needs:

- Incorporate structure into succession planning: Assess options during leadership transitions.

- Review governance policies periodically: Ensure alignment with stakeholder expectations.

- Engage in dialogue with shareholders: Transparency around board structure builds trust.

- Define and empower the chair role: Clarity of responsibility enhances function.

- Support development: Provide tools and training for board leadership roles.

Looking Ahead

As of 2025, separating the CEO and chair roles is no longer considered an outlier move. While not universally adopted, it is now seen as a governance best practice that boards proactively consider as part of a broader commitment to effective oversight.

Ultimately, governance is not static. It must adapt to organizational maturity, market expectations, and strategic demands. This noted, the decision to separate roles should reflect thoughtful consideration, rather than being driven by compliance or other pressures.

For companies undergoing change, succession, or strategic shifts, re-evaluating leadership structure is a consistent responsibility of the board. By keeping an open mind and engaging in candid discussion, boards position themselves to serve shareholders, employees, and stakeholders more effectively. Governance maturity is a journey, with role separation an option on that path, worthy of consideration.

Co-Authors:

Christos Richards, Partner, Global Head of Healthcare & Life Sciences

David Schumer, Managing Partner, Head of Financial Services & FinTech

Luis DeAnda, Partner, Head of Consumer Practice

Antonia Halliday, Partner and Financial Officer Practice Leader

James Flashman-Fox, Partner, Head of Sports Media Practice

Severine Balick, Partner, Head of Sustainability, Climate and Impact Investing Practice

Victoria Lakers, Partner, U.S. Private Equity and B2B Software Practice Leader

James Brocket, Co-Founder, Managing Partner Europe and EU High Tech Practice

Tom Barnes, Co-Founder, Managing Partner U.S. & North America High Tech Practice