By Jed Donnelly

I’ve always been intrigued by board composition and more specifically when, and in what way, companies bring in expertise from outside their industry. My anecdotal recollection from twenty-plus years of recruiting in the life sciences has always been that large pharmaceutical companies tended to have more of these outside directors than smaller companies. My personal experience with board searches for entrepreneurial companies has almost always focused on finding specific biotech related experience (e.g., oncology approvals; launching spec pharma products, getting a company acquired).

Even before the U.S. Government announced plans for some sort of direct purchase (outside of insurance) plan, I had been moved to revisit this issue as several recent podcast conversations I have listened to have focused on bringing life sciences straight to the patient/consumer market. True consumer offerings are more common in the diagnostics space, ranging from routine, at-home tests (e.g., pregnancy tests, glucose monitors, and more recently COVID tests) to more involved genetic analysis offerings like 23andMe, but the area of at home testing is continually expanding and is seen as a large area of future growth, as noted in a recent Inside Precision Medicine conversation.[1] An August 2025 episode of the Interesting Times podcast[2] featured a CEO whose company is expanding on the practice of preimplantation genetic testing in IVF to offer prospective parents full genetic sequencing of embryos accompanied by a risk analysis for potential diseases. A September 2025 Endpoints Post-Hoc interview[3] regarding the launch of Corsera Health featured a section of the conversation focused on Corsera’s planned consumer targeted approach to preventative medicine.

It was this latter conversation that really got me thinking about how biopharma companies could benefit from the experience of other industries because the traditional use of “direct to consumer” in pharma refers to public advertising campaigns that now fill magazines and commercial breaks and encourage the bombarded masses to “talk to their doctor.” More recently we have seen attempts by companies like Hims and Hers Health, Inc. to directly market prescription products to consumers using a combination of telehealth and compounding pharmacies (which as of September 2025 is drawing increased FDA scrutiny). But in these situations, the offerings are mostly limited to “lifestyle” areas – weight loss, hair loss, ED – although they appear to be attempting to expand into other areas. The dietary supplements market, at roughly $400 billion globally,[4] has shown that consumer demand for preventative health products is strong, but much of that market is looked on with skepticism and more recently has been dealing with fraudulent medical endorsements created with artificial intelligence.[5] This area, then, seems ripe for a new approach informed by executives from other industries.

In thinking about cross-industry experience on boards of directors, I first wanted to look at actual numbers across the industry to verify my personal recollections, so I examined the boards of directors at commercial biopharmaceutical companies with significant revenues (>$500M). This approach, as opposed to looking at the broader pool of all public companies, seemed to fit best with the direct-to-consumer inspiration and seemed to be the likely subset where cross-industry experience would be most applicable. This gave me a list of 75 companies, based on data from BoardEx, and I considered the top 17 as “large” revenue companies. (While the top 15 would have been more natural, there was a significant revenue drop between companies 17 and 18 that appeared to be a more relevant dividing line.)

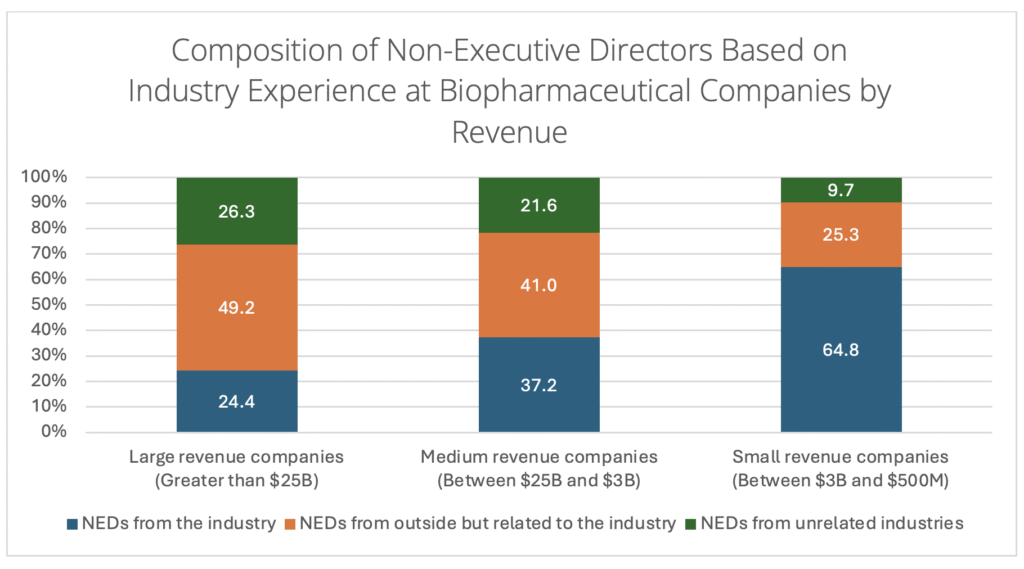

When looking at the non-executive directors on the boards of these companies, my recollections were confirmed, with the large revenue companies having roughly 75.5% of non-executive director seats held by directors from outside of industry, while the smaller revenue companies only had 45.3% of seats held by these directors. When I sub-divided the small revenue company group into medium and small, using $3 billion in annual revenues as the divider the pattern continued, with medium revenue companies having 62.7% of board seats filled from outside the industry and smaller revenue companies being at 35.1%. However, many of these directors are still very connected to the industry – professors of medicine, accountants or bankers with careers focused on life sciences, etc. – and don’t address the issue of bringing experience from other industries. When looking at board directors truly unrelated to biopharmaceuticals, the percentages dropped to 26.3%, 21.7% and 9.7% for large, medium, and small revenue companies, respectively.

These percentages show that smaller revenue companies tend to have fewer board directors from outside the life sciences industry and that less of those directors are from unrelated industries. At large and medium revenue companies, about one in three outside directors come from unrelated industries. But for smaller revenue companies, that number drops to roughly one in four. Furthermore, it drops to one in five for U.S. based companies in the smaller revenue group, with only 6.5% of non-executive directors coming from unrelated industries. With an average eight non-executive directors per board that’s one “unrelated” director for every two companies.

So, what does this tell us?

First, as companies grow, they naturally begin to broaden the experience on their boards—bringing in more outside voices and perspectives beyond life sciences. That may be worth considering earlier in a company’s journey, especially when approaching commercialization. Second, and this is more of an opinion, is that if a company is trying to break new ground, they may want to be a little innovative in where they source their new board talent. In reviewing 75 companies, most of the non-industry directors came from traditional, industrial sectors like aerospace, defense, and consumer goods conglomerates, and very few from high tech, digital, or consumer targeted companies. This seems to be a missed opportunity – a large pool of untapped executive talent that could be beneficial to growing pharmaceutical companies, if they are willing to tap into it.

[1] Mara Aspinall: Taking Diagnostics from Pitch to Patient http://bit.ly/3HOL1In

[2] The Next Parenting Trend Starts Before Conception https://www.nytimes.com/2025/08/07/opinion/genetics-children-noor-siddiqui.html

[3] Endpoints Post-Hoc https://www.youtube.com/live/lLZOMTLM4M4

[4] https://www.precedenceresearch.com/nutritional-supplements-market

[5] https://www.nytimes.com/2025/09/05/technology/ai-doctor-scams.html